ASSET financing - over £500m/E600m FUNDED to date

We connect capital with assets via transactions that we personally believe to be interesting

and we often look to co-invest alongside our partners.

LIVING

We have advised on projects in hotels, student, private rental, co-living and social housing sectors.

COMMERCIAL

We have advised on deals in the logistics, retail and storage sectors.

SPECIAL SITUATIONS

We have advised on deals in distressed, NPLs and DPO situations.

- We specialise infinding debt (senior or mezzanine) or equity (preferred equity or JV equity) for growth and development strategies.

- We are very active now in finding refinancing solutions for assets that need new senior debt, ormezzanine or pref equity to fill refinancing gaps.

- We operate in the UK and Western Europe and have executed funding transactions in the UK, Spain,Portugal, Italy and Greece.

CAPITAL SOURCING

FVC uses its extensive network of capital spanning family offices, private equity funds, alternative investment funds and high net worth individuals to ascertain what the smart funding solution might be on a transaction by transaction basis.

PRINCIPAL INVESTMENTS

We like to commit our own capital alongside that of our trusted network. We think it makes sense and our partners like it. So we do it.

Our investments include:

BUMPER

Consumer finance for car servicing/repairs

ASF provides car dealerships in the UK with the ability to offer their customers free 3 month finance on their car repairs and maintenance expenses.

IWOCA

INSTANT WORKING CAPITAL FOR SMALL BUSINESS

Simple credit facilities for the working capital needs of small businesses of up to £100,000. No commitments, no hidden fees, no hassle.

Digital Box

digiital Performance marketing

A suite of digital marketing tools which enable advertisers and agencies to target, engage and acquire precise audiences at scale.

Lending Stream

Fast, Flexible and responsible short term finance

A San Diego based alternative finance business which provides responsible short term loans to the UK sub prime and near-prime market.

FVC NEWS

Fair Value Capital were proud to announce Auto Service Finance, a company we invested in day one, won the Best Alternative Lender Award at the Credit Strategy Awards.

Auto Service Finance (ASF) won its second FinTech award at the Credit Strategy’s Credit Awards 2019 in the Alternative Lender of the Year category. The winners at the Credit Awards were selected by a panel of judges who look to reward companies for their “hard work, innovative outlook and industry-shaping solutions”.

Fair Value Capital advised the Reuben Brothers on the acquisition of the Curtain Club Hotel in London.

The Curtain, which opened in summer 2017, is held Freehold and comprises over 115,000 SQF (GIA) of space over six stories and 120 luxury bedrooms and suites featuring steam showers, a private members’ club, a rooftop pool and restaurant overlooking the City skyline, wellness centre, live performance room as well as co-working space for members and hotel guests.

Fair Value Capital advised the Experimental Group on the acquisition of an old office building which was converted into the Palazzo Experimental in Venice.

Il Palazzo Experimental, is a boutique hotel with 32 elegantly designed rooms and suites, and a spacious back garden letting onto a quiet canal. The Palazzo’s Dorsoduro neighborhood hosts Galleria dell’Accademia and the Peggy Guggenheim Collection, making it the perfect place to let yourself amble in its charming streets.

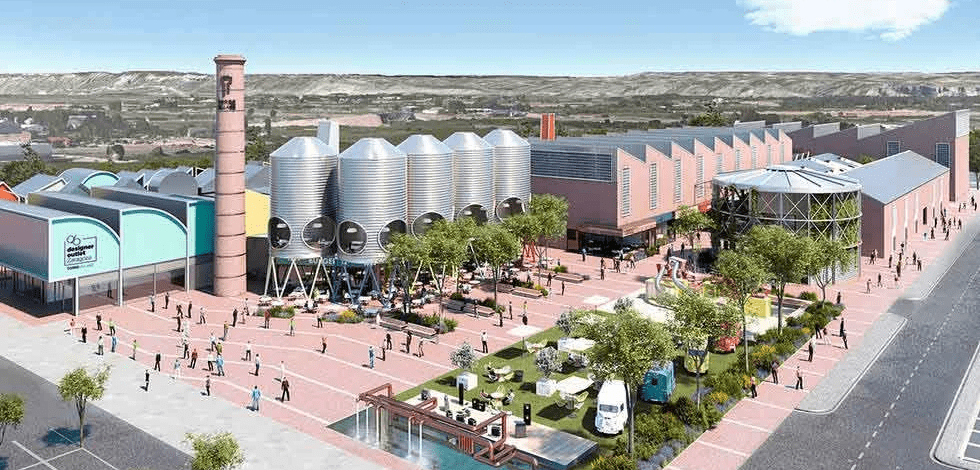

Fair Value Capital advised US REIT W.P. Carey on the acquisition of a logistics facility in the East Midlands.

The 726,000 sq ft Dixons Carphone logistics facility leased on a long-term, triple-net basis, is part of Dixon’s largest and key distribution platforms in the UK. Dixons Carphone Plc is the UK’s retail market leader in the electronics and telecommunications sector.

Fair Value Capital advised the owners of Aguas de Ibiza on a €60mm investment to finance the development of 300 residential units in Ibiza.

Who we are

We are experts in debt and equity financing for assets and

also have principal investment capability if required.

Patrick Brennan

CEO

Prior to founding Fair Value Capital, Patrick was responsible for alternative credit investments including structured credit, commercial and residential mortgage related debt and distressed debt at Schroders. Before this Patrick co-managed Pioneer CB Arbitrage hedge Fund, co-founded Credit Market Analysis (later sold to the Chicago Mercantile Exchange), and served as a Vice President in Merrill Lynch's EMEA group where he ran a proprietary trading business in structured credit. | Linked In

Joaquin Lassala

Advisory Board

Joaquin joined Fair Value Capital in early 2016 to source and under-write investment opportunities across the UK and mainland Europe. Prior to FVC, Joaquin was responsible for the acquisition of several residential portfolios across Scandinavia for the William Pears Group. In addition to this, he worked closely with local partners to expand the Pears’ family Real Estate portfolio into the Spanish market. From 2012 to 2015 Joaquin headed the European acquisitions division at Thor Equities and acquired several high-end retail assets both in the UK and across Europe. | Linked In

Nicholas Roe

Vice Chairman & Advisory Board

Prior to joining Fair Value Capital, Nick was at Citigroup where he held a number of key senior management positions. Nick was lastly the EMEA Head of Investor Services and Direct Clearance & Custody Services within Citigroup where he was responsible for services and personnel across 32 countries in Europe, Middle East and Africa.

Prior to Citigroup, Nick had been Global Head of Prime Finance at Deutsche Bank AG and before worked for 12 years at Morgan Stanley.

In 2010, Nick was inducted into Global Custodian’s ‘Hall of Legends’ and has served on many industry advisory boards including AIMA, ATP Arbejdsmarkedets Tillægspension, and was Chairman of Citigroup Investment Deutschland KAG from 2006-2009.

Angela Alvarez

Vice Chairman & Advisory Board

Angela has chaired international executive positions and Boards, mainly in M & A, Investment and Banking, having completed numerous international transactions mainly in the Finance, Real Estate and Hotel sectors. She was Head of Investment Banking and a member of the Risk Committee of the Iberian Special Assets Situations unit in BBVA, Member of the Executive Committee of BBVA Consumer Finance and the Digital Bank Uno-e Bank, Head of Corporate Development at BBVA for the acquisitions of Consumer Finance, Insurance and Financial Institutions in Europe, Asia, USA and Brazil. She also Headed the Corporate Finance and M&A European FIG team in Spain at KPMG. Prior to that she worked at PWC Corporate Finance, Bankinter, Citibank, and AVB | Linked In

Stephen Marks

Vice Chairman & Advisory Board

Stephen has joined the team to give commercial property expertise. During a 26 year career as a real estate lawyer working in the city – (including 12 years as a partner) Stephen acted for pension funds, private equity houses, private individuals, overseas investors, charities, public bodies, health authorities, property companies, governments, developers, banks and hoteliers. In the last 10 years of his legal career he concentrated mainly on acquisitions and disposals and large corporate and hotel portfolio deals . Additionally Stephen advises real estate investors and developers on sustainability, wellness and ESG and he is accredited with the International Well Building Institute and the Global Wellness Institute.

CONTACT DETAILS

patrick@fairvaluecapital.co.uk

zara@fairvaluecapital.co.uk

info@fairvaluecapital.co.uk

FCA disclaimer

The information contained in this website is intended solely for general information. It is not intended as a solicitation for business nor an offer to enter into any transaction. Prospective qualifed clients and investors should always inform themselves and take appropriate advice as to any applicable legal requirements, taxation regimes and exchange control regulations in the countries of their citizenship, residence or domicile which may be relevant to the services described on this website. In general, the value of and income from investments may go up or down.

This website may contain, hyperlink or refer to information which has been obtained from sources Fair Value Capital (UK) Limited believes to be reliable but which Fair Value Capital (UK) Limited does not represent to be accurate or complete. No legal or other liability can be assumed for information which may not accurately reflect changes since publication in terms of information and representation.

The content displayed on this website may be proprietary and is provided for information only. Downloading, copying, linking to or distributing such content anywhere for any purpose except with the prior written permission of the management of Fair Value Capital (UK) Limited is strictly forbidden. If you have any query or issue with the information displayed on this website, please inform Fair Value Capital (UK) Limited (Email: info@fairvaluecapital.co.uk) in the first instance.

This website may use cookies to track visitors to the site and their page usage. We may maintain this data in our private computer systems for marketing purposes. By accessing this site, you are consenting to this potential tracking and to the maintenance of your data in our systems.

Fair Value Capital(UK) Ltd is an appointed representative of Crito Capital LLP which is authorised and regulated by the Financial Conduct Authority.